IRA Calculator FAQs

All information in the IRA Calculator, including the FAQ page below, is provided by Rewiring America.

Top FAQs

When can I access the IRA’s incentives?

All tax credits are available now, and you can read the IRS’ guidance on 25C and 25D here. The rebates should start to become available by the end of 2023. We don’t know exactly when the rebates marked “late 2023” will be available, because it will depend on how each state rolls out its incentive program.

Will the IRA incentives be retroactive?

All tax credits were available starting January 1, 2023, so save your receipts for filing season! If you installed rooftop solar in 2022, it is eligible for the new, 30% 25D tax credit. If you installed a heat pump in 2022, it is eligible for the old 25C tax credit: 10% of costs up to $300. The Electrification Rebates and Efficiency Rebates will likely not be retroactive.

Do I need to spend a lot to get these incentives?

In many cases, no! The IRA’s incentives are designed to increase access to clean technology. For households with lower incomes, up to 100% of appliance and installation costs are discounted at purchase, meaning you could install efficient electric appliances at no cost, with no spending.

Middle-income households do have to spend in order to access savings, but up to 50% of appliance and installation costs can be covered through upfront discounts, and you can use tax credits to cover some of the remaining gap. Highest-income households are not eligible for upfront discounts, so you will have to pay full price for appliances and installation — but tax credits on the back end could recoup up to 30% of your costs.

Can the IRA help me if I’m a renter?

Yes! The IRA’s up-front electrification rebates and electrification tax credits can all be used by renters. Many of these upgrades — including window-unit heat pumps (which should qualify by 2024/2025), electric stoves/cooktops, and heat pump clothes dryers — are portable, so renters can bring them to their next homes and won’t have to leave any savings behind. Renters are also eligible for the used and new EV tax credits. And although they’re not exactly consumer-facing, renters will benefit from the IRA’s $1 billion investment in affordable housing energy upgrades and the new tax deduction for efficiency upgrades in commercial buildings (including apartment buildings). Renters can also subscribe to community solar — which will be cheaper because of the IRA’s supply-side renewable energy incentives.

Can I benefit from other electrification incentives in addition to what’s in the IRA?

Probably! It’s up to your state, local government, and utility to decide if you’re allowed to stack their incentives on top of the IRA’s rebates and tax credits, but we think most of them will allow it.

Household Information

Who should I include in my household?

You should include anyone that you claim as a dependent on your taxes. That could be children, grandparents, or other relatives who you support financially. You should also include your spouse or domestic partner if you file taxes together.

Whose income should I include in my household?

If you are married, you should include your spouse’s income. If you claim any dependents with income on your taxes, you should include their income, too. If you receive child support, social security income, or other types of non-taxable income, include those too.

How does my income determine which incentives I get?

Some incentives, like the Electrification Rebates and the electric vehicle tax credits, are income-limited, so our calculator uses your income and zip code to figure out if you qualify.

How the incentives work

If the tax credits are available now, how do I actually take advantage of them?

The IRS will continue to publish guidance on the tax credits, so stay tuned for more information. If you’re planning to claim a 25C tax credit (for heat pumps, heat pump water heaters, electrical panels, or weatherization) or 25D tax credit (for rooftop solar, geothermal, or battery storage), you should:

- Check out the IRS FAQ on 25C and 25D and our fact sheet on 25C and 25D.

- Make sure your household will owe enough federal income tax to be offset by the value of the credit.

- Make sure your purchase meets the tax credit’s relevant efficiency and/or product standards. For 25C, heat pumps and heat pump water heaters must meet the Consortium for Energy Efficiency’s highest “non-advanced” tier. For more information on 25C and 25D product standards (i.e., panel capacity, battery size, etc.) see the IRS FAQ on 25C and 25D.

- Save your receipts.

- Get ready to fill out a form! The IRS will release updated forms that you’ll submit come next tax season.

If you’re planning to claim a tax credit for new or used EVs, or for an EV charger, you should:

- Check out the IRS pages for the new EV credit and the used EV credit, and keep an eye out for guidance on the EV charger credit.

- Make sure your household will owe enough federal income tax to be offset by the value of the credit. For the EV credits, this will only be necessary for 2023. Starting in 2024, you’ll be able to access the EV credits as an upfront discount from your dealer, so your federal tax liability won’t matter.

- Make sure your household qualifies for the tax credit. Everyone qualifies for 25C and 25D, but not everyone qualifies for the EV credits (by income) or the EV charging credit (by geography). For more information on income limits, see the IRS pages on the new EV credit and the used EV credit.

- Make sure your purchase meets the new EV tax credit’s relevant production/content requirements.

- Save your receipts.

- Get ready to fill out a form! The IRS will release updated forms that you’ll submit come next tax season.

Do the rebates and tax credits cover installation costs as well as purchase costs?

Yes! The rebates and tax credits all cover purchase and installation costs. There’s one exception: for weatherization, the 25C tax credit covers only purchase costs (25C covers purchase and installation costs for everything else).

Can you carry tax credits forward?

The IRA’s new 25D tax credit is a carryforward credit, meaning that you will be able to carry unused credit over to future years. The 25C tax credit is not a carryforward credit, so you will not be able to carry it forward.

Are there still wood stove tax credits?

A wood stove tax credit of $2,000 is included in the new 25C tax credit. Wood stoves are no longer eligible for the 25D tax credit.

Are there requirements for heat pump efficiency?

Yes. The Electrification Rebates apply only to ENERGY STAR-certified appliances (where such categories exist), including heat pumps, heat pump water heaters, heat pump clothes dryers, and weatherization products. The 25C tax credit applies only to heat pumps and heat pump water heaters in the Consortium for Energy Efficiency’s highest “non-advanced” tier, ENERGY STAR-certified doors, and ENERGY STAR Most Efficient-certified windows.

Can multiple incentives be combined for one purchase?

It depends! The Electrification Rebates and Efficiency Rebates can both be combined with the tax credits. So, for example, a moderate-income family could receive an Electrification Rebate for 50% of the cost of a new heat pump, and then claim a tax credit against the remaining cost. The rebate programs cannot be combined for the same single upgrade (i.e., the same heat pump), but the two programs can be stacked for different upgrades within the same project. The rebates and tax credits will likely be stackable with state, local, and utility incentives, but that’ll be up to local rulemakers.

How will my income be verified for the incentives?

We don’t yet know how your income will be verified. Federal and state agencies will release guidelines over the next few months, and we’ll update this page once we know more.

For Electrification Rebates eligibility, will household income be based on Adjusted Gross Income (AGI) or Gross Income? And what’s the difference?

Household income will likely be based on AGI, or Adjusted Gross Income, but we won’t know for sure until the programs are implemented by each state. Your gross income is your total income (including wages, dividends, retirement distributions, and other income). Your AGI is your gross income minus any adjustments such as retirement contributions, student loan interest, or alimony payments.

How will Electrification Rebates work?

For eligible consumers, the Electrification Rebates will act as point-of-sale discounts on the purchase and installation of qualifying electrification upgrades. In other words, when you buy and install a new, eligible appliance, the discount will be taken right off the sticker price from your retailer or contractor. Appliance retailers and contractors will likely play an important role in processing the discounts, but the full value of the rebates is mandated to be passed directly to consumers. For more details on the program, look out for implementation guidance from the Department of Energy and program proposals from State Energy Offices.

The rebates may be implemented differently in each state, so we cannot guarantee final amounts, eligibility, or timeline. And without additional appropriations from Congress, the rebate programs will end once their initial IRA funding is exhausted.

How do the Efficiency Rebates work?

The Efficiency Rebates are designed to incentivize improvements in whole-home energy efficiency. Specifically, the rebates reward modeled (pre-project) energy savings of at least 20% or measured (post-project) energy savings of at least 15%. Like the Electrification Rebates, implementation details will be determined by guidance from the Department of Energy and program proposals from State Energy Offices.

The rebates may be implemented differently in each state, so we cannot guarantee final amounts, eligibility, or timeline. And without additional appropriations from Congress, the rebate programs will end once their initial IRA funding is exhausted.

Can multiple members of my household claim the Electrification Rebates or the Efficiency Rebates?

No. The rebate programs are tied to households and appliances, not individuals.

Does the IRA include incentives for community solar?

Yes! If you’re a partial owner of a community solar installation, you might be eligible for the consumer-facing 25D tax credit. If you’re a “subscriber” to a community solar project owned by a developer (including nonprofits, co-ops, and local governments), the developer might be eligible for the supplier-facing 48C tax credit. In either case, the IRA will further reduce the cost of community solar.

Are portable heat pumps covered?

Portable, window-unit heat pumps are like window-unit ACs that also blow hot air, so they’re a great option for renters who want to electrify their heating. Portable heat pumps don’t yet meet the efficiency standards for 25C and the Electrification Rebates, but they should qualify by 2024 or 2025.

Are there incentives available for landlords?

Yes! Landlords of multifamily buildings can take advantage of the Electrification Rebates and the Efficiency Rebates. More guidance for landlords should come soon. Additionally, landlords can utilize the 30C tax credit for EV charging (the business version, which is 30% of costs up to $100,000 per charger). Landlords cannot take advantage of the 25C tax credit for energy efficiency upgrades or the 25D tax credit for solar and storage, but they can utilize the Section 48 investment tax credit for rooftop solar (30% of costs). Landlords of buildings four stories or taller can also utilize the 179D Energy Efficient Commercial Buildings Deduction.

How the calculator works

Do you sell any of my personal data?

No, we do not. As of November 1st, we are now collecting the calculator inputs, including zip code and household information. We will aggregate and anonymize this data to better understand who is interested in the IRA incentives and to build lists of qualified contractors for certain zip codes. We also store the inputs in local storage inside your web browser to improve the user experience.

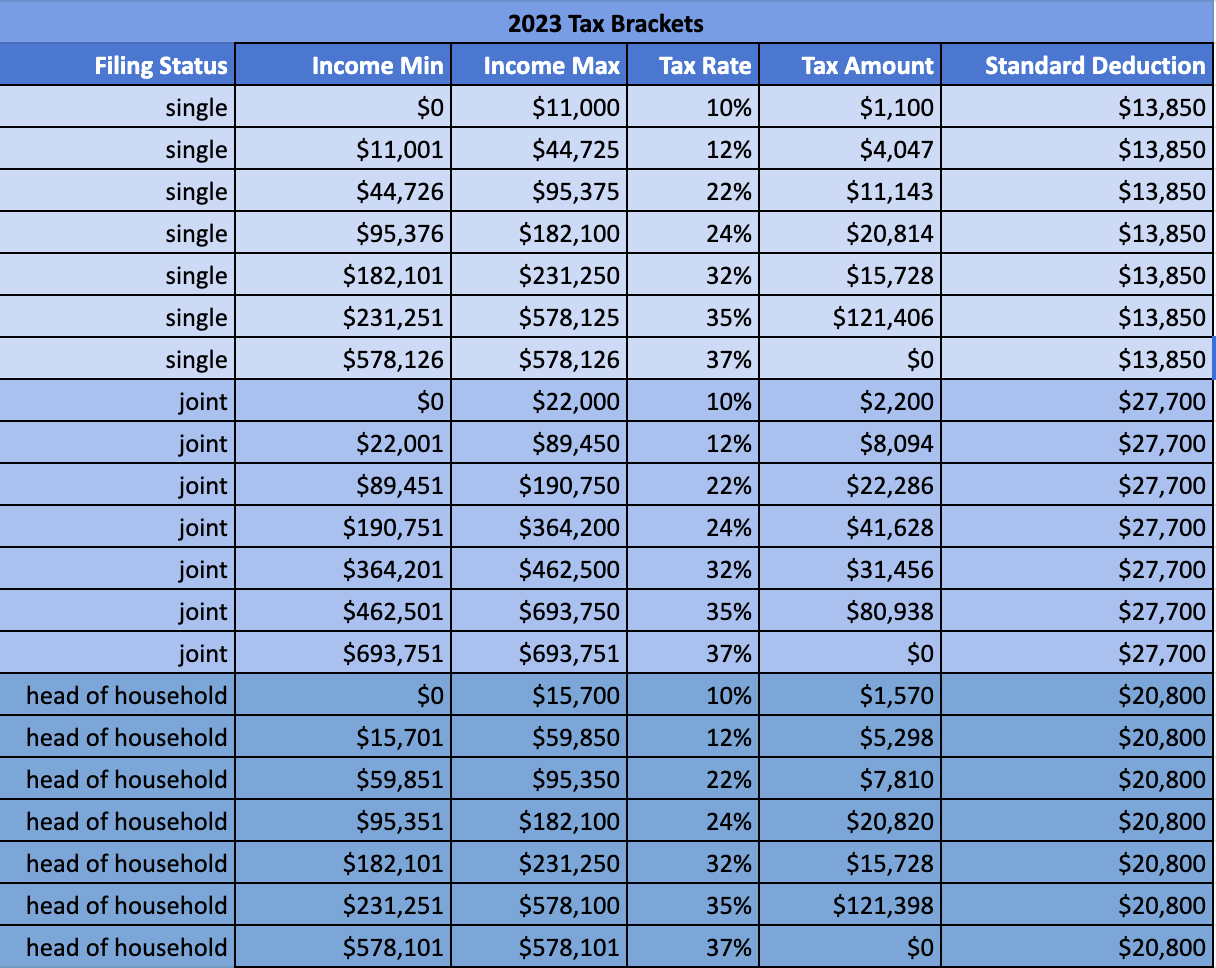

How is this calculator estimating taxes?

The United States taxes income progressively, meaning that how much you make will place you within one of seven federal tax brackets. It also takes into account whether you are single, jointly file as a married couple, or are considered a head of household. Once we have calculated federal taxes owed, we apply the non-itemized standard deduction that all Americans are eligible for regardless of filing status or income.

How did you choose specific rebates for renters?

For renters, we’re highlighting incentives for portable appliances, so you won’t have to leave the appliances or any potential savings behind. These portable appliances include window-unit heat pumps (which should qualify by 2024/2025), electric stoves, heat pump clothes dryers, and electric vehicles.

How do you calculate eligibility for the Electrification Rebates?

The Department of Housing and Human Development (HUD) calculates the Area Median Income (AMI) for every census tract and is available here. Eligibility for the Electrification Rebates is based on your household income in relation to your AMI. If your household income is below 80% of AMI, you are eligible for the maximum point-of-sale rebates. If you are between 80% and 150% of AMI, you are eligible for up to 50% of appliance and installation costs through point-of-sale rebates, and you can use tax credits to cover some of the remaining gap. In both cases, the maximum discount is $14,000.

HUD calculates the 80% AMI for households of 1-8 people. HUD applies exceptions and adjustments for many geographic areas, which makes the math pretty confusing! Depending on your inputted household size, we will look up the appropriate 80% AMI for your zip code. HUD does not yet calculate 150% AMI, so we have calculated that number ourselves based on the 80% AMI numbers.

What is the difference between HUD’s Median Family Income (MFI) and Area Median Income (AMI)?

The term Area Median Income (AMI) is the term used more generally in the affordable housing industry. If AMI is used in an unqualified manner, this reference is synonymous with HUD’s Median Family Income (MFI). However, if the term AMI is qualified in some way — generally percentages of AMI or AMI adjusted for family size — then this is a reference to HUD’s income limits, which are calculated as percentages of median incomes and include adjustments for families of different sizes.

What are your data sources?

- HUD Tables (Data for Section 8 Income Limits)

- HUD State Median Incomes

- Estimated Cost per watt for rooftop solar by state

- NREL Geothermal equipment and installation estimates (national)

- NREL Battery storage equipment and installation estimates (national)

- 2023 Tax year rate tables and standard deductions brackets

Electrifying your home

I want to start electrifying my home! What should I do first?

Rewiring America created a handy guide with all the steps to electrify your home and everything you need to know about electric appliances. You can download it here.

I want to learn even more about the IRA. Where should I look?

Rewiring America created a “Go Electric Guide to the IRA” with more information about the IRA’s incentives and case studies that map the incentives onto real-life electrification journeys. You can download it here.

Glossary

What is a tax credit?

A tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s actual, final bill.

What is a tax deduction?

A tax deduction is a provision that reduces taxable income.

What is a carryforward tax credit?

A carryforward tax credit allows you to “carry forward” the value of a tax credit to future years if you cannot use the full tax credit value in one year.